- What can BER incentive offer to your business?

Businesses that start or take-over an activity in French Ardennes “Bassin d'Emploi à Redynamiser” (BER) area, before December 31th 2024 can access tax and social security benefits that are almost unique in France: up to five years of exemption from tax and social security charges.

- What tax exemptions are involved?

Tax on profits: Five years flat

- Corporate income tax (IS)*: levied on profit over a financial year

- Income tax (IR): for individual entrepreneurs subject to the tax regime known as « Bénéfices Industriels et Commerciaux » (BIC)

Economic contribution: Five years flat

- Levy on a company's value added contribution (“Cotisation sur la valeur ajoutée des entreprises” or CVAE) calculated based on turnover and added value of the business or group

- "Cotisation Foncière des Entreprises" (CFE): based on estate property subject to property tax

Property tax on buildings (“Taxe foncière sur les propriétés bâties” or TFPB): Five years flat

(unless otherwise decided by local authority in charge)- The municipal share of the TFPB

- The intermunicipal share of the TFPB

- The departmental share of the TFPB

*N.B. The corporate income tax exemption only applies if the business does not distribute share dividends

- What is Ardennes Développement’s role with regard to the BER?

The role of Ardennes Développement, the French Ardennes economic development agency is to:

- Prospect for and guide new setups

- Support industrial and service companies

- Promote economic development in the Ardennes

Within this framework, Ardennes Développement promotes the BER, an incentive that is almost unique in France, and provides initial information through its special website and BER simulator.

- To which municipalities does the BER apply?

Available only in two employment areas in France:

- The BER area of Vallée de la Meuse in the Ardennes with 351 municipalities (if your municipality is eligible, it will be in the list on the exemption simulator)

- An area in the Midi-Pyrénées region

These areas were defined by Decree No.2007-228 of 20/02/2007.

- Which activities are eligible?

The exemptions are for industrial, commercial or artisanal activities. Activities that are non-commercial but subject to corporate income tax are also eligible.

Eligible businesses:

- Individual businesses subject to the tax regime known as "Bénéfices Industriels et Commerciaux" (BIC)

- Companies or groups subject to the partnership tax regime known as "Régime des sociétés de personnes"

- Companies or organisations subject to corporate income tax (IS) automatically or as an option

- Associations subject to tax on revenue

Industry exclusions:

- Leases to purchase movable property and rental of real estate for residential or agricultural use

- Non-commercial activities (pure holdings, rental of unequipped buildings, etc.)

Setup conditions:

To be granted exemptions, a business starting its work in a BER area must be fully located within the area, meaning its means of doing business are physically located there and its work takes place there.

- Special case: itinerant businesses

To satisfy this setup condition, an itinerant* business must have physical premises (store, office, workshop, etc.) and its means of doing business in the area, and meet at least one of the following two criteria:

- A non-itinerant staff member is employed full-time or equivalent at premises in the area

- At least 25% of turnover is generated in the area

*Itinerant activities mainly take place outside the business premises. In practice, they are carried out by companies whose business mainly or exclusively takes place at client premises or in public spaces. The office located in the area may only have an administrative role: often incidental given its size.

- What social security exemptions are involved?

The URSSAF social security agency exemption includes:

- Employer social security contributions (illness, maternity, disability, death, old age) and child benefit

- The National Fund for Housing Assistance known as the “Fonds National d’Aide au Logement” (FNAL)

- The transport tax known as “versement transport”

This exemption is limited to 1.4 times the hourly minimum wage (SMIC) multiplied by the number of hours remunerated. Beyond remuneration equivalent to 1.4 times the SMIC, the exemption only applies up to the limit.

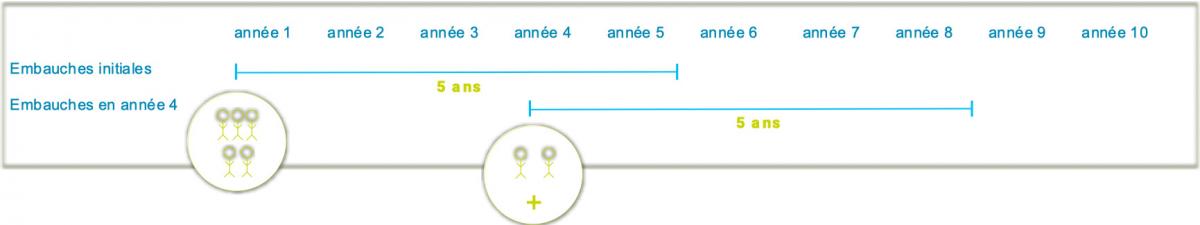

If staff are hired within five years of the setup date, the exemption applies to them for five years from the date the employment contract takes effect.

- Are BER exemptions limited?

Yes. With the exemptions being treated as state aid, they are governed by European legislation on state aid for companies with two mechanisms:

- The “de minimis” rule

This sets a ceiling for state aid for a single business (or single group) of €200,000 (€100,000 for transport companies) per three sliding tax years: the total aid obtained for tax years one, two and three should not exceed €200,000 and the total for tax years two, three and four should not exceed €200,000, etc.)

or

- Optionally, regional aid zones known as AFR for 120 municipalities in the Ardennes

The ceiling permitted in this case is a calculation rather than a set amount: Eligible costs x rates Eligible costs: investments (excluding rentals and leases to purchase movable property) or wage costs for jobs created.

Rates: according to the company size based on the European Union definitions

- 30% for small businesses

- 20% for medium business

- 10% for large businesses

- What steps are involved in accessing the exemptions?

The BER incentive is a tax and social security scheme. It is therefore very different from other state aid schemes which often require an application.

The BER involves options to be formulated and tax and social security declarations (either preliminary or annual). These are often produced by an accountant (e.g. applicable exemptions on social security charge slips).

- Who should you contact?

Ardennes Développement promotes the BER incentive, provides initial information and helps you quickly assess the BER’s potential using the BER simulator. Our scope is mainly focused on industrial and service companies.

For further information, please contact your accountant. Since the BER is a tax and social security incentive, accountants are often responsible for the process to be carried out. They will also know how to prepare ahead of time (with prior analysis, advice, studies, forecasts, etc.).

You can also contact local “Service des Impôts des Entreprises” (SIE) tax office with questions about tax and the URSSAF social security agency with queries about social security.

- Are you eligible for the BER?

The BER incentive is deliberately broad in scope so that a significant number of businesses can benefit.

While Ardennes Développement cannot comment on whether a specific project is eligible, we can give you general guidance. Only tax services can officially comment on eligibility. You can request a tax ruling for this purpose, although this is not compulsory. Your accountant may support you with this process, but can certainly do all the preparation work (advice, financial business plan, etc.).